Seven Steps to Auto Enrolment

Posted on 13th March 2017 at 11:09

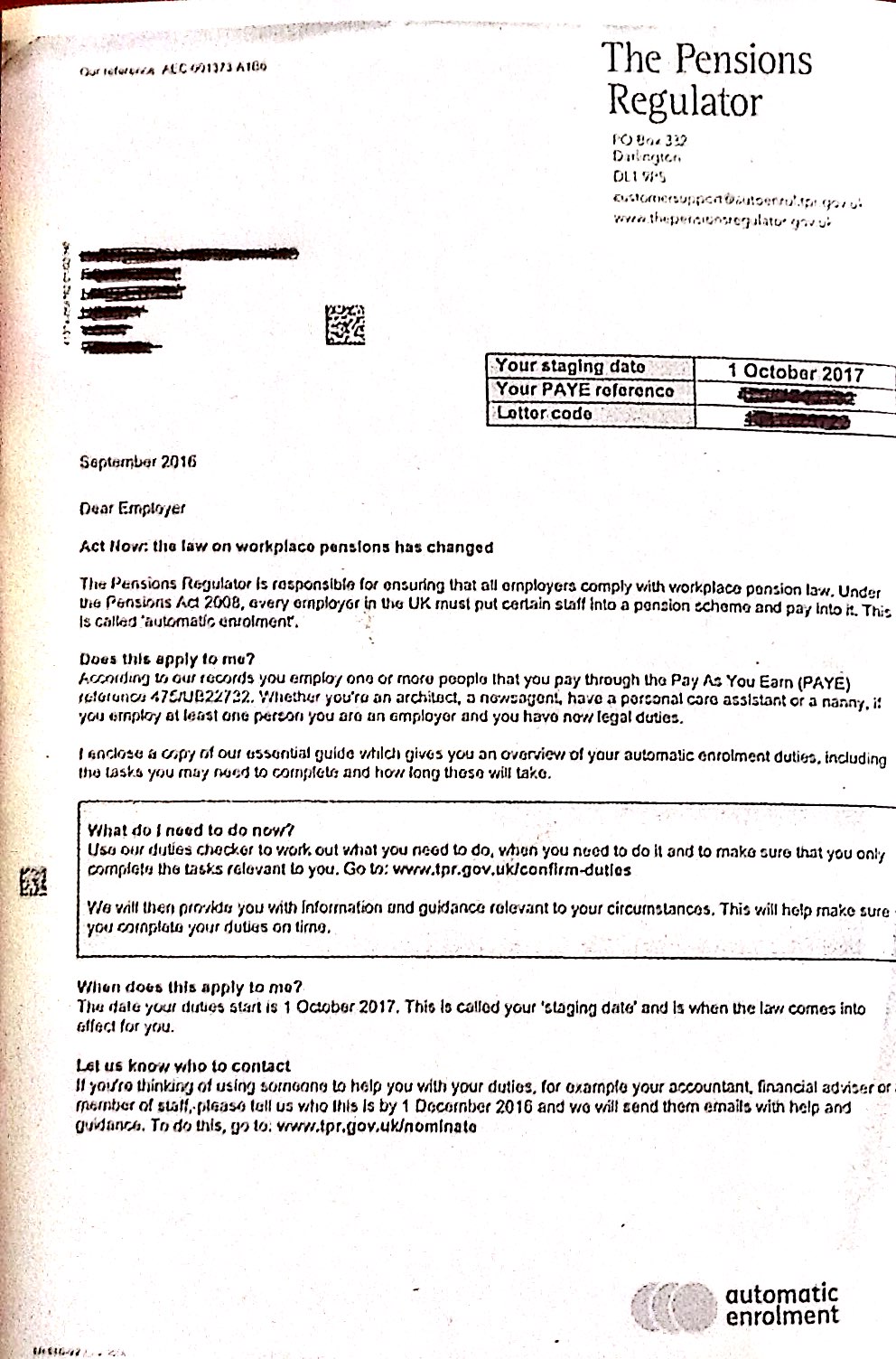

NOT SURE WHAT TO DO ABOUT YOUR LETTER FROM THE PENSIONS REGULATOR?

It’s not so hard as you might think.

Once set up the ongoing monthly process should be no more difficult than paying your PAYE and NI.

The 7 steps to set up are as follows :-

1. Initial assessment of workers

Workers are categorised as eligible jobholders , non eligible jobholders and entitled workers .

2. Deciding which earnings to use

You can choose whether to use Qualifying Band Earnings , Total gross earnings or basic salary.

3. Deciding what rate of contributions to pay

The minimum rates will depend on which earnings you decide to use . You can choose whether to go straight to the minimum levels required from April 2019 or to phase this in over time.

4. Deciding what provider to use

You need a clear process and audit trail showing how you reached your decision . Considerations you may wish to take into account are as follows:-

• Durable – stands the test of time.

• Well invested – offering a suitable default investment fund and appropriate range of funds.

• Well administered – ensuring you meet your employer obligations under the auto-enrolment regulations.

• Offering suitable support to your workforce at retirement.

• Properly engaging with your workforce at outset and during the time they invest in it.

• Offering value for money.

5. Set up of scheme and payroll

Different schemes and different payroll providers have different requirements.

6. Issue communications to workers

These must include certain statutory requirements as well as explaining what is happening in plain English.

7. Submit compliance statement

HELP AVAILABLE

We are here to help you through this process hand holding at every step of the way and ensure you have the relevant detailed information to help you through the decisions you need to make.

This would include:

- detailed estimates of the costs of each of the contribution options in summary and by individual

- report of pension providers willing to offer you a workplace pension based on your actual data with costs and a balanced score identifying those which are a good fit for you

- communications tailored to your choices and your employees

Set up your free no obligation meeting with Elaine Tarver today by calling 0771 275 1336 or email elaine.tarver@millpensions.co.uk

The meeting will last no more than half an hour to help us understand your circumstances, explain your obligations based on your actual workforce and identify your specific needs.

Tagged as: Auto Enrolment

Share this post: